washington state long term care tax opt out rules

Opting out of the long-term-care payroll tax is more complicated than necessary suggesting its just a nice gesture. Implementation of SHB 1732 and ESHB.

Wa House Passes Pause To Long Term Care Program And Tax

A delay of the long-term-care law that mandates the program and its tax was.

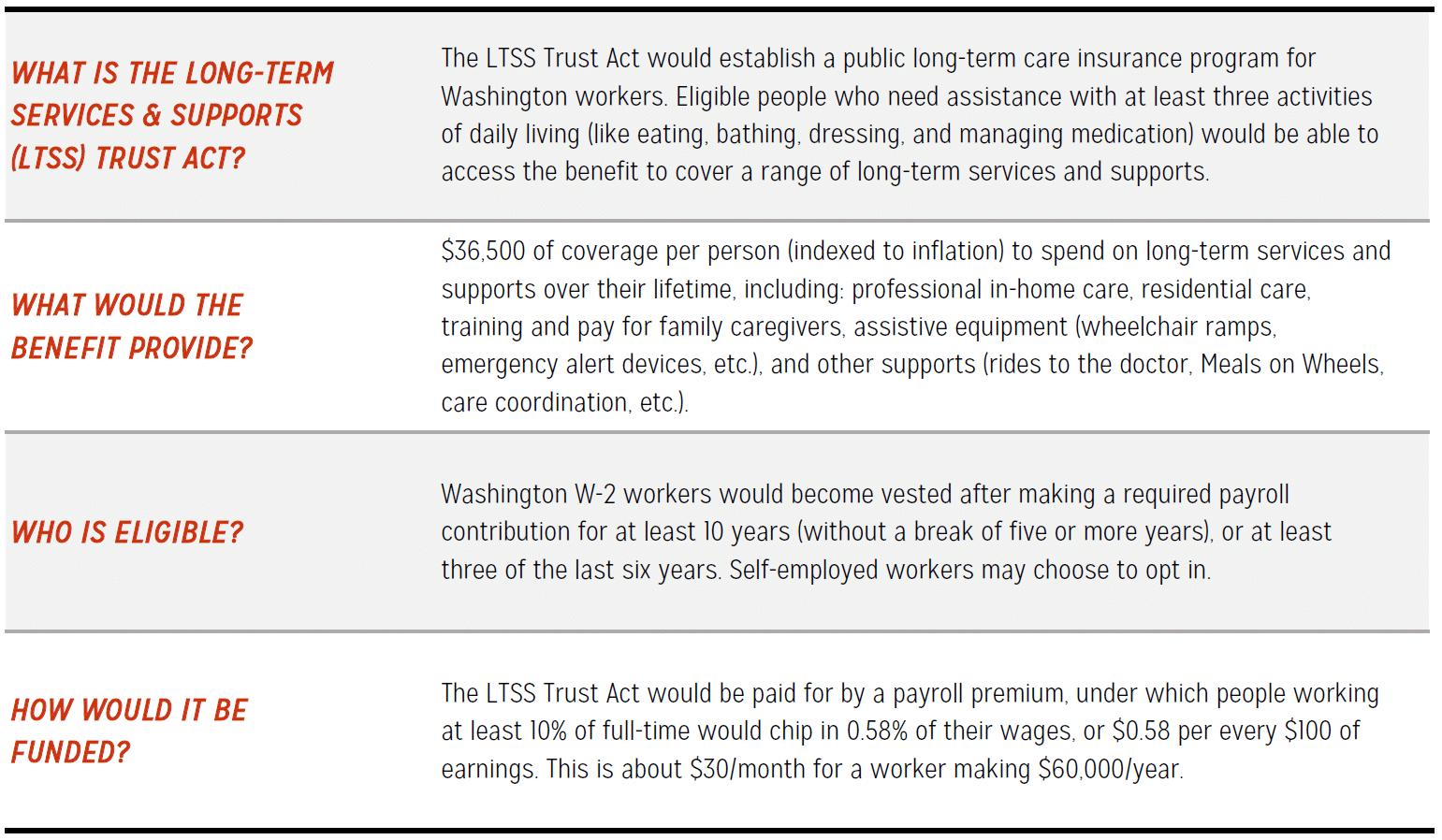

. Any employee who attests that they have comparable long-term care insurance purchased before. Long-Term Services and Supports LTSS is now called WA Cares Fund. As a reminder in April 2021 the Washington State legislature passed a law requiring individuals to 1 pay into a long-term care fund or 2 opt out of paying into the fund by proving that they.

Under this law individuals will have access to a lifetime benefit amount that should they need it they can use on a wide range of long-term services and supports. The only way to do so is to obtain their own long-term care policy. Up until the law was changed in March 2022 the only workers in Washington who were exempted from the program were those who owned long-term care insurance with an.

November 1 2021 is the deadline to avoid the new tax by. Turns out they were a bit premature. On January 27 th Governor Jay Inslee signed House Bill 1732 which delays implementation of the long-term care payroll tax in Washington State for 18 months.

Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply. Basics of the WA Cares Tax. Visit us at wacaresfundwagov.

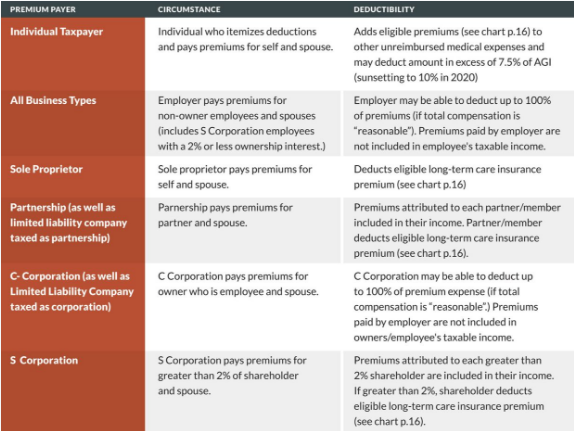

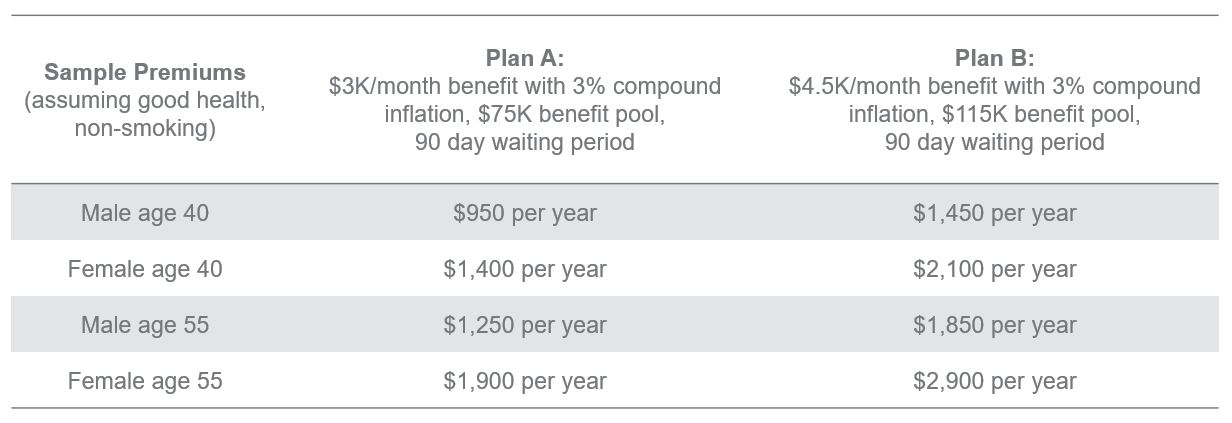

It will soon bring workers in our state a new payroll tax of 58 cents for every 100 of wages. LEARN ABOUT WA CARES. The tax will total 058 percent of your W-2 income with no maximum limit.

WA Cares Fund is a long-term care insurance tax of 058 of gross wages of workers in the state of Washington. Washington state long term care tax opt out rules Wednesday October 5 2022 Edit With the update of the Washington Long-Term Care Trust Act about 250000 MORE. In that case the tax will be.

Opting back in is not an option provided in. Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. This means that if you purchased.

During the last legislative session lawmakers approved. Individuals who have private long-term care insurance may opt-out. Under the current law residents of Washington have one opportunity to opt-out of this tax.

Private insurers may deny coverage based on age or health status. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term. For example employees who earn a 125000 annual salary will pay.

While its been clear since the outset that the most. The Twins signed Correa to a three-year 1053 million deal in March with opt-outs after each of the first two seasons. Opting Out of The Washington State Long-Term Care Tax After an employees application for exemption is processed and approved he or she will receive an approval letter.

Individuals who have private long-term care insurance may opt-out.

Opinion New Payroll Tax To Hit Workers This Fall For Mandated Long Term Care Program But State Commission Has Few Answers On How It Will Work Clarkcountytoday Com

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

The Essential Guide To Group Long Term Care Insurance

Long Term Services And Supports Ltss Dshs

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Washington Workers Have A Short Time To Escape A New Payroll Tax The Seattle Times

Time Expiring For Washington Residents In 30s And 40s To Avoid New Tax American Association For Long Term Care Insurance

Washington Ltc Trust Act Opt Out Long Term Care Insurance For The Ones You Love

Repealing The Unpopular Long Term Care Insurance Program And Regressive Payroll Tax Washington State House Republicans

Washington Is Close To Making History On Long Term Care Budget And Policy Center

Making Sense Of Washington S New Long Term Care Law Parker Smith Feek Business Insurance Employee Benefits Surety

Wa State Long Term Care Insurance Tax Exemptions Information

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 11 Bogleheads Org

Washington State Long Term Care Tax Here S How To Opt Out

Can You Opt Out Of State S New Long Term Care Act And Tax Should You

What S Next For Beleaguered Wa Long Term Care Program Crosscut

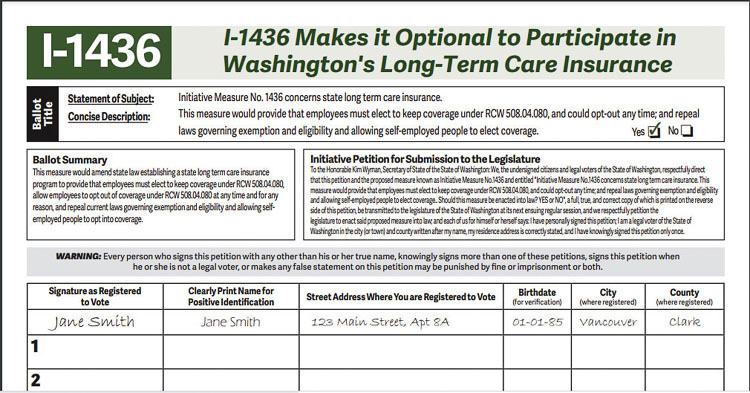

I 1436 Will Give Workers Choices On State S Long Term Care Insurance Program Clarkcountytoday Com

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety

Analyst S Advice For Washingtonians Who Got Private Long Term Care Insurance Mynorthwest Com